Inflation in Pakistan Comes Down to Single Digit After Three Years

- byAdmin

- Sep 2, 2024

- 1 year ago

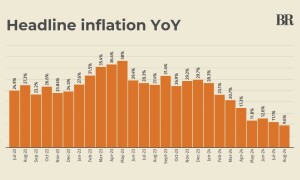

Inflation in Pakistan has dropped to single digits for the first time in three years, recording a year-on-year rate of 9.6% in August 2024. This is a significant improvement from the 11.1% rate seen in July 2024, according to data from the Pakistan Bureau of Statistics (PBS). The last time inflation was this low was in October 2021, when it stood at 9.2%.

On a month-to-month basis, the Consumer Price Index (CPI) increased by 0.4% in August 2024, which is a slower rise compared to the 2.1% increase in July 2024 and the 1.7% rise in August 2023.

This latest reading aligns with the official forecasts, as the Ministry of Finance had projected that inflation in August would range between 9.5% and 10.5% in its monthly economic outlook. The ministry also expects inflation to decline further, predicting it will drop to 9-10% in September 2024. The Ministry of Finance’s report stated, “Given the stability in economic indicators, inflation is anticipated to stay within the 9.5-10.5% range in August and further decline in September.”

This decrease in inflation comes after the State Bank of Pakistan (SBP) reduced its key policy rate by 100 basis points in its Monetary Policy Committee (MPC) meeting in July, bringing the policy rate to 19.5%. The SBP had cited potential risks to the inflation outlook, including fiscal challenges and energy price adjustments, but felt confident enough in the overall economic environment to reduce rates.

In recent years, inflation has posed a major economic challenge for Pakistan. In May 2023, the inflation rate hit a record high of 38%. However, since then, it has been steadily declining, providing some relief to consumers and businesses alike.

The August inflation rate is also consistent with predictions made by various financial analysts and brokerage firms. JS Global had anticipated the inflation rate to reach 9.3%, marking the return to single digits after three years. They noted that the reduced inflation strengthens the case for further interest rate cuts by the MPC in their September meeting, possibly by another 150 basis points, which would bring the policy rate down to 18%.

Similarly, Arif Habib Limited (AHL) also predicted that the easing cycle of interest rates that started in June 2024 would continue. AHL had projected that the August inflation rate would land around 9.6%. Looking ahead, they foresee the policy rate dropping to between 14% and 14.5% by June 2025, with the possibility of a 100 basis point cut in September 2024.

Urban and Rural Inflation Breakdown

The PBS data further highlights the inflation divide between urban and rural areas. In urban areas, CPI inflation was recorded at 11.7% year-on-year in August 2024, down from 13.2% in July 2024 and 25.0% in August 2023. On a month-to-month basis, urban inflation saw a smaller increase of 0.3% in August 2024, compared to 2.0% in July 2024 and 1.6% in August 2023.

Rural inflation, on the other hand, was lower, coming in at 6.7% year-on-year in August 2024, compared to 8.1% in July 2024 and 30.9% in August 2023. On a month-to-month basis, rural CPI inflation increased by 0.6% in August 2024, down from the 2.2% increase seen in July 2024 and 1.9% in August 2023.

What Does This Mean for Pakistan?

The drop in inflation to single digits is a positive sign for Pakistan's economy, especially after years of double-digit inflation that strained households and businesses. The lower inflation rate could help stabilize consumer prices, making goods and services more affordable for the public. Furthermore, this decline gives the State Bank of Pakistan more room to continue lowering interest rates, which could further stimulate economic activity by reducing borrowing costs for businesses and consumers.

However, it’s important to note that inflation remains higher in urban areas compared to rural regions, reflecting differences in price pressures across the country. This urban-rural inflation gap will need to be monitored, as it may affect the economic well-being of different communities in Pakistan.

Additionally, while inflation has come down, potential risks remain. Factors such as fiscal slippages, energy price adjustments, and global economic conditions could influence future inflation trends. Policymakers will need to stay vigilant to ensure that inflation remains on a downward path and doesn’t rise again.

Conclusion

Pakistan's inflation rate has dropped to 9.6% in August 2024, marking the first time in three years that the rate has returned to single digits. This decrease provides some much-needed relief for consumers and signals a positive development in the country's economic recovery. With the potential for further interest rate cuts in the coming months, the inflation outlook for Pakistan appears optimistic, though risks remain. For now, the decline in inflation is a step in the right direction, offering hope for continued economic stability in the future.

Post a comment

Hot Categories

Recent News

Pakistani Martial Artist Rashid Naseem Sets a New Guinness World Record

- Aug 9, 2024

- 1 year ago

Daily Newsletter

Get all the top stories from Blogs to keep track.

0 comments